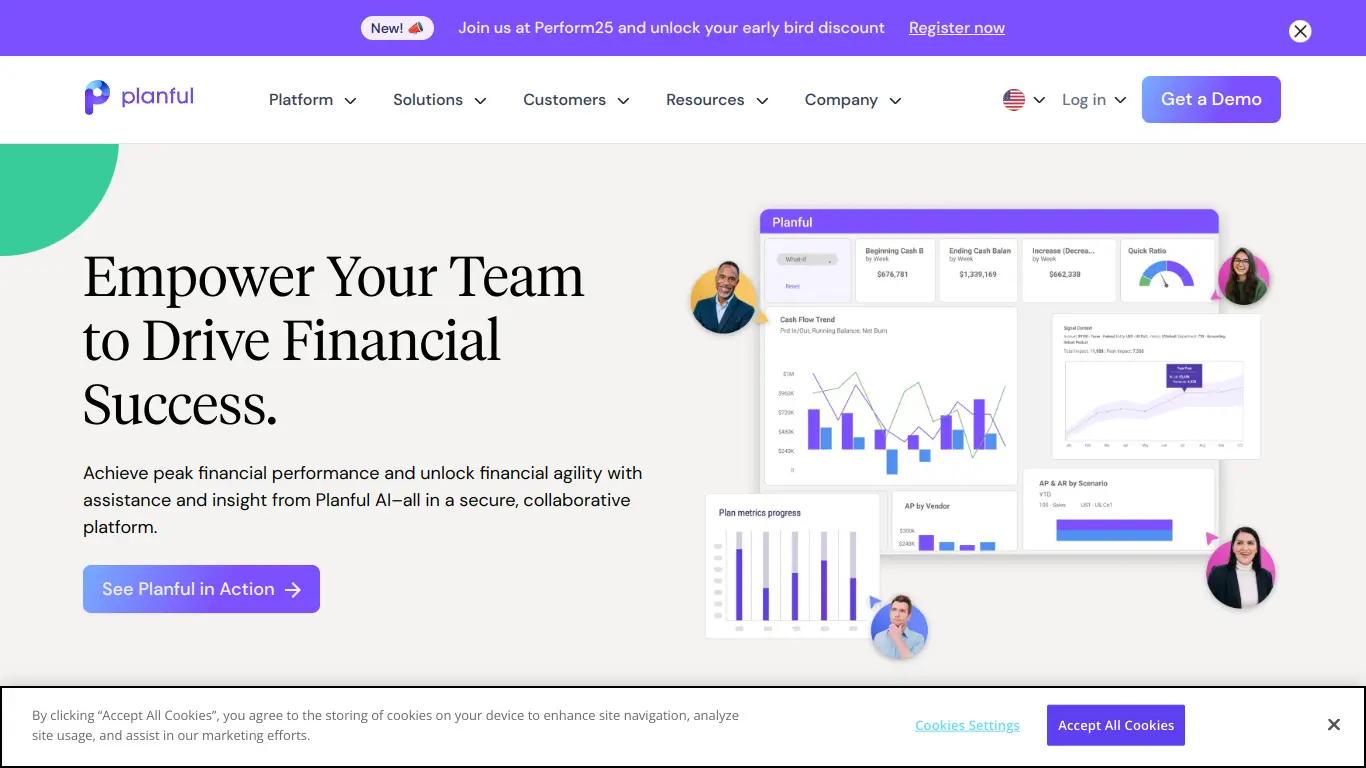

Planful is a cloud-based FP&A platform that streamlines budgeting, forecasting, consolidation, and reporting for finance teams seeking to modernize operations.

Are you spending countless hours on manual budgeting spreadsheets, struggling with disjointed financial processes, or finding it difficult to align your finance team with operational departments? If you’re nodding your head, you’re not alone. Financial planning can feel like navigating a labyrinth, especially when your tools aren’t keeping pace with your business needs. This is where Planful enters the picture—a solution designed to transform how businesses approach financial planning and analysis.

Introduction to Planful

What is Planful and its Purpose?

Planful (formerly Host Analytics) is a comprehensive financial planning and analysis (FP&A) platform that helps finance teams streamline planning, consolidation, reporting, and analytics. The platform is built to eliminate spreadsheet chaos, automate tedious financial processes, and create a single source of truth for financial data across organizations.

At its core, Planful aims to modernize the office of the CFO by providing cloud-based solutions that connect financial and operational planning, consolidating financial results, and enabling dynamic reporting and analytics. This creates a continuous planning environment where finance and operational teams can work together more effectively.

Unlike traditional financial management tools that often focus solely on historical data analysis, Planful emphasizes forward-looking planning capabilities while still maintaining robust financial close and consolidation features. The purpose is simple: to give finance teams more time for strategic analysis by reducing the time spent on manual processes.

Who is Planful Designed For?

Planful caters primarily to mid-market and enterprise companies across various industries including manufacturing, healthcare, technology, retail, and financial services. The platform is especially beneficial for:

- CFOs and Finance Leaders seeking to modernize their financial processes and elevate the strategic role of finance

- Financial Planning & Analysis Teams looking to streamline budgeting, forecasting, and reporting workflows

- Accounting Departments needing efficient solutions for financial close and consolidation

- Business Unit Leaders who need to participate in planning processes and access financial insights

- IT Teams aiming to reduce the technical burden of maintaining legacy finance systems

Organizations that have outgrown Excel for complex financial planning but don’t want the cost and complexity of legacy on-premises solutions find particular value in Planful’s offering.

Getting Started with Planful: How to Use It

Getting started with Planful follows a structured implementation approach:

- Discovery Phase: Planful’s team works with you to understand your specific financial planning challenges, current processes, and goals.

- Implementation: The platform is configured to match your business requirements, with customized templates for your planning, reporting, and consolidation needs.

- Integration: Planful connects with your existing ERP systems, CRM platforms, HR solutions, and other data sources to create a comprehensive financial ecosystem.

- Training: Users receive role-based training to ensure they can effectively use the aspects of the platform relevant to their responsibilities.

- Ongoing Support: After going live, Planful provides ongoing support and regular product updates to keep improving your financial processes.

The platform operates through a user-friendly interface with purpose-built applications for different financial functions, making it accessible for finance professionals without requiring deep technical expertise.

Planful’s Key Features and Benefits

Core Functionalities of Planful

Planful offers a comprehensive suite of financial management capabilities, organized into several key modules:

1. Continuous Planning

- Dynamic, rolling forecasts that adapt to business changes

- Driver-based planning that connects operational metrics to financial outcomes

- Collaborative workflows for cross-departmental input

- What-if scenario modeling for testing different business assumptions

2. Financial Close & Consolidation

- Automated collection and consolidation of financial data

- Multi-currency translation and intercompany eliminations

- Compliance with accounting standards (GAAP, IFRS)

- Audit trails and controls for financial integrity

3. Reporting & Analytics

- Self-service reporting for finance and business users

- Dashboard visualizations for key metrics

- Variance analysis to identify areas needing attention

- Drill-down capabilities to explore underlying data

4. Structured Planning

- Purpose-built applications for specific planning processes

- Templates for common planning use cases

- Guided workflows for complex financial activities

- Pre-built integrations with operational systems

5. Workforce Planning

- Headcount planning and management

- Salary and compensation modeling

- HR metric integration

- Resource allocation optimization

Advantages of Using Planful

Implementing Planful delivers several significant benefits to finance teams and the broader organization:

🚀 Increased Efficiency

- Reduces budget cycle times by up to 50%

- Automates up to 80% of routine financial processes

- Decreases report generation time from days to minutes

🔄 Improved Accuracy

- Eliminates error-prone manual data entry

- Ensures data consistency across the organization

- Provides a single version of financial truth

⏱️ Time Savings

- Frees finance teams from spreadsheet maintenance

- Reduces close cycle times by 25-40%

- Enables more time for strategic analysis

📊 Better Decision Making

- Provides timely insights to business leaders

- Enables data-driven planning and forecasting

- Supports multiple scenario analyses for risk management

🤝 Enhanced Collaboration

- Connects finance with operational departments

- Enables real-time collaboration on plans and forecasts

- Improves communication between headquarters and business units

☁️ Cloud Benefits

- Reduces IT costs and maintenance requirements

- Ensures regular feature updates without disruption

- Provides enterprise-grade security and compliance

Main Use Cases and Applications

Planful serves numerous financial planning and analysis needs across organizations:

Annual Budgeting

Streamlines the often cumbersome annual budget process by enabling simultaneous input from multiple stakeholders with central controls and automated consolidation.

Rolling Forecasts

Supports dynamic forecasting beyond the annual budget, allowing organizations to adapt plans as business conditions change and maintain a forward-looking view.

Financial Consolidation

Automates the collection and consolidation of financial results from multiple entities, handling currency conversion, intercompany eliminations, and other complex accounting requirements.

Management Reporting

Creates executive dashboards, variance analyses, and performance reports that provide actionable insights without manual compilation.

Strategic Modeling

Enables long-term financial modeling, acquisition analysis, and capital structure planning with sophisticated scenario capabilities.

Operational Planning

Extends financial planning to sales, marketing, supply chain, and other operational areas to create alignment between financial and operational strategies.

Exploring Planful’s Platform and Interface

User Interface and User Experience

Planful has invested heavily in creating an intuitive user experience that balances powerful functionality with accessibility. The platform’s interface features:

Modern Design

- Clean, visually appealing layouts

- Consistent navigation patterns

- Responsive design that works across devices

Role-Based Views

- Customized interfaces for different user roles

- Simplified views for occasional users

- Comprehensive tools for power users

Interactive Elements

- Drag-and-drop functionality for report creation

- Visual workflow builders

- Interactive dashboards with filtering capabilities

The platform strikes a balance between Excel’s flexibility (which finance users value) and purpose-built applications that guide users through specific processes. This approach makes Planful accessible to finance professionals without requiring extensive technical training.

Key UX Elements:

- Spreadsheet-like grids for familiar data entry

- Guided workflows for complex processes

- Visual cues for data validation and exceptions

- Contextual help and guidance

Platform Accessibility

Planful prioritizes platform accessibility in several dimensions:

Technical Accessibility

- Cloud-based delivery requiring only a web browser

- Mobile-responsive design for on-the-go access

- Offline capabilities for certain functions

- SSO (Single Sign-On) support for enterprise environments

User Accessibility

- Multiple language support

- Role-based security controls

- Customizable user permissions

- Training resources for different learning styles

Data Accessibility

- API connectivity to other systems

- Direct integration with common ERP platforms

- Data import/export capabilities

- Self-service reporting options

The platform can be accessed anytime, anywhere through modern web browsers, making it suitable for globally distributed teams and remote work environments. This cloud-based approach ensures that all users have access to the latest version of the software and the most current data.

Planful Pricing and Plans

Subscription Options

Planful operates on a subscription-based pricing model, with costs determined by several factors:

| Plan Type | Best For | Key Features | Typical Annual Cost |

|---|---|---|---|

| Standard | Mid-sized companies with basic FP&A needs | Core planning, reporting, dashboards | Custom pricing based on company size |

| Professional | Larger organizations with complex planning requirements | Advanced modeling, comprehensive consolidation | Custom pricing based on company size |

| Enterprise | Large enterprises with sophisticated FP&A needs | Full platform capabilities, premium support | Custom pricing based on company size |

Pricing factors include:

- Number of users (both power users and casual users)

- Company size and complexity

- Modules implemented

- Implementation services required

- Data volume and integration needs

While Planful doesn’t publish specific pricing on their website, industry research suggests that implementations typically start at around $50,000 annually for smaller organizations and can range into six figures for large enterprises with comprehensive needs.

Free vs. Paid Features

Planful is primarily an enterprise software solution and doesn’t offer a traditional freemium model with permanent free access. However, they do provide:

Free Resources:

- Product demonstrations and guided tours

- Educational webinars and thought leadership content

- Self-assessment tools for FP&A maturity

- Case studies and best practice guides

Paid Services Beyond Core Subscription:

- Advanced implementation services

- Custom integrations with legacy systems

- Managed services for ongoing administration

- Premium support packages

- Strategic advisory services

Planful occasionally offers limited-time trials for qualified prospects, allowing companies to experience the platform before making a commitment. These trials typically include guided implementation of a specific use case to demonstrate value.

Planful Reviews and User Feedback

Pros and Cons of Planful

Based on user reviews across multiple platforms (G2, Capterra, TrustRadius), here’s a balanced assessment of Planful’s strengths and limitations:

👍 Pros:

- Comprehensive functionality that covers the full spectrum of FP&A needs

- Strong consolidation capabilities that handle complex multi-entity requirements

- User-friendly interface compared to legacy FP&A solutions

- Excel-like familiarity that eases adoption for finance users

- Regular platform updates with new features and improvements

- Responsive customer support with finance domain expertise

- Flexible modeling to adapt to various business requirements

- Strong security and compliance features

👎 Cons:

- Implementation complexity can be challenging for organizations with limited resources

- Learning curve for non-finance users who participate in planning processes

- Custom report building requires technical skills to master fully

- Integration depth varies depending on source systems

- Advanced customization may require professional services

- Mobile experience is functional but not as robust as desktop

- Higher cost compared to point solutions that address only specific FP&A needs

User Testimonials and Opinions

Real customers have shared their experiences with Planful across various review platforms:

“Planful has transformed our budgeting process from a three-month marathon to a six-week sprint. The collaboration features allow our department heads to input their own forecasts while finance maintains control of the overall process.”

— Finance Director, Mid-size Manufacturing Company

“The consolidation functionality handles our complex multi-currency, multi-entity close process with ease. What used to take us two weeks now happens in three days, with better accuracy and transparency.”

— Controller, Global Technology Company

“Implementation was more involved than we initially expected, but the ROI has been clear. We’ve eliminated countless spreadsheets and have a single source of truth for our financial plans.”

— CFO, Healthcare Organization

“The reporting capabilities give our executives the visibility they need without finance having to produce custom reports for every request. Self-service analytics has been a game-changer for us.”

— FP&A Manager, Retail Chain

According to aggregated review scores, Planful typically receives ratings between 4.2 and 4.6 out of 5 stars, with particularly high marks for functionality breadth, financial consolidation capabilities, and customer support quality.

Planful Company and Background Information

About the Company Behind Planful

Planful (formerly Host Analytics) has established itself as a significant player in the financial planning and analysis software market:

Company History:

- Founded in 2000 as Host Analytics

- Pioneered cloud-based EPM (Enterprise Performance Management) solutions

- Rebranded to Planful in 2020 to reflect their vision of continuous planning

- Acquired by private equity firm Vector Capital in 2018

- Subsequently acquired Planful, now backed by TPG Growth

Leadership:

Planful is led by CEO Grant Halloran, who brings extensive experience from previous leadership roles at Anaplan and Infor. The executive team combines deep finance expertise with technology innovation backgrounds.

Company Growth:

The company has shown consistent growth, particularly since its rebranding and strategic pivot to emphasize continuous planning capabilities. While exact revenue figures aren’t public, industry analysts estimate annual revenue in the $100-150 million range.

Market Position:

Planful is recognized in analyst reports from firms like Gartner and Forrester as a significant player in the FP&A software space, particularly strong in serving mid-market enterprises with sophisticated financial needs but limited IT resources.

Corporate Values:

The company emphasizes customer success, continuous innovation, and its understanding of finance professionals’ unique challenges. Their approach balances technological advancement with practical financial application.

Global Presence:

Headquartered in Redwood City, California, Planful maintains offices across North America, Europe, and Asia-Pacific, serving customers worldwide.

Planful Alternatives and Competitors

Top Planful Alternatives in the Market

The FP&A software market offers several alternatives to Planful, each with different strengths:

- Anaplan (https://www.anaplan.com/)

- Known for: Connected planning across finance and operations

- Best for: Large enterprises with complex, cross-functional planning needs

- Workday Adaptive Planning (https://www.workday.com/en-us/products/financial-management/adaptive-planning.html)

- Known for: User-friendly interface and Workday ERP integration

- Best for: Organizations using Workday for HR/Finance or seeking ease of use

- OneStream (https://www.onestreamsoftware.com/)

- Known for: Unified platform for CPM (Corporate Performance Management)

- Best for: Large enterprises with sophisticated consolidation requirements

- Prophix (https://www.prophix.com/)

- Known for: Mid-market focus and industry-specific solutions

- Best for: Mid-sized companies seeking dedicated industry expertise

- Vena Solutions (https://www.venasolutions.com/)

- Known for: Excel-centric approach to planning and budgeting

- Best for: Organizations wanting to preserve Excel while adding governance

- Board (https://www.board.com/)

- Known for: Combined BI and planning capabilities

- Best for: Companies seeking unified analytics and planning platform

- Solver (https://www.solverglobal.com/)

- Known for: ERP integration focus, particularly with Microsoft Dynamics

- Best for: Microsoft-centric organizations seeking tight ERP integration

Planful vs. Competitors: A Comparative Analysis

Here’s how Planful compares to some of its primary competitors across key dimensions:

| Feature/Aspect | Planful | Anaplan | Workday Adaptive | OneStream |

|---|---|---|---|---|

| Target Market | Mid-market to enterprise | Primarily enterprise | SMB to enterprise | Primarily enterprise |

| User Experience | Finance-friendly, Excel-like | More technical modeling | Highly intuitive | Comprehensive but complex |

| Implementation Time | 2-4 months typical | 3-6+ months typical | 1-3 months typical | 4-6+ months typical |

| Consolidation Strength | Very strong | Moderate | Moderate | Extremely strong |

| Operational Planning | Good, improving | Excellent | Good | Good |

| Excel Integration | Strong | Moderate | Strong | Strong |

| Pricing Range | $$$-$$$$ | $$$$-$$$$$ | $$-$$$$ | $$$$-$$$$$ |

| Key Differentiator | Balance of finance depth with ease of use | Highly flexible connected planning | User-friendly, rapid adoption | Unified platform without compromises |

Where Planful Typically Wins:

- Organizations seeking deep financial capabilities without extreme complexity

- Companies with significant consolidation needs but limited IT resources

- Businesses that value finance-led implementations rather than IT-led projects

- Mid-sized enterprises outgrowing spreadsheets but not ready for largest platforms

Where Competitors Often Win:

- Anaplan: For highly complex, cross-functional planning beyond finance

- Workday Adaptive: For Workday ERP customers or those prioritizing ease of use

- OneStream: For largest enterprises with extremely complex consolidation requirements

- Specialized vendors: For industry-specific solutions in sectors like banking or healthcare

Planful Website Traffic and Analytics

Website Visit Over Time

According to third-party analytics tools, Planful.com shows healthy traffic patterns typical of a growing B2B SaaS company:

- Monthly Traffic Range: Approximately 60,000-80,000 visits per month

- Traffic Trend: Steady growth of 15-20% year-over-year

- Seasonal Patterns: Traffic peaks during Q4 and early Q1, aligning with annual budgeting seasons

- Content Performance: Educational resources and thought leadership content drive significant engagement

The site shows strong engagement metrics with relatively low bounce rates for B2B software (typically in the 45-55% range) and average session durations around 3-4 minutes, indicating qualified interest from visitors.

Geographical Distribution of Users

Planful’s website traffic reflects its global market presence, with visitor distribution concentrated in:

- North America (65-70%)

- United States: 55-60%

- Canada: 8-10%

- Europe (15-20%)

- United Kingdom: 5-7%

- Germany: 3-4%

- Other European countries: 7-9%

- Asia-Pacific (8-10%)

- Australia: 3-4%

- India: 2-3%

- Other APAC countries: 3-4%

- Rest of World (3-5%)

This distribution aligns with Planful’s market focus and office locations, with the strongest presence in North America followed by growing adoption in European and Asia-Pacific markets.

Main Traffic Sources

Planful’s website attracts visitors through diverse channels:

📊 Traffic Channel Distribution:

- Organic Search: 40-45%

- Direct Traffic: 25-30%

- Referral Traffic: 12-15%

- Paid Search: 8-10%

- Social Media: 5-7%

- Email Marketing: 3-5%

The strong organic search performance indicates effective SEO strategies and content marketing, while the healthy direct traffic suggests brand recognition among target audiences. Referral traffic comes primarily from industry publications, analyst sites, and technology partners.

Top Search Terms driving organic traffic relate to financial planning challenges (“financial planning software,” “FP&A solutions,” “budgeting and forecasting tools”) and specific capabilities (“financial consolidation software,” “rolling forecast solutions”).

Frequently Asked Questions about Planful (FAQs)

General Questions about Planful

What is Planful used for?

Planful is a financial planning and analysis (FP&A) platform that helps finance teams streamline budgeting, forecasting, financial consolidation, reporting, and analysis. It provides a cloud-based solution to modernize financial processes and connect financial and operational planning.

Is Planful different from Host Analytics?

Yes, Planful is the new name for Host Analytics following a rebranding in 2020. The company changed its name to better reflect its vision of continuous, collaborative planning while maintaining the same core platform and expertise.

How long does Planful implementation typically take?

Implementation timeframes vary based on complexity, but most organizations can implement their first use case within 2-4 months. Full platform implementations with multiple modules may take 4-6 months or longer for large enterprises with complex requirements.

Is Planful suitable for small businesses?

Planful is primarily designed for mid-market and enterprise organizations. Small businesses with simple financial processes may find the solution more robust than needed, though growing companies with complex financial requirements can benefit from the platform.

Feature Specific Questions

Can Planful integrate with our ERP system?

Yes, Planful offers pre-built integrations with major ERP systems including Oracle, SAP, NetSuite, Microsoft Dynamics, and others. Custom integrations can also be developed for specialized systems using Planful’s API capabilities.

Does Planful support rolling forecasts?

Yes, rolling forecasts are a core capability of Planful. The platform enables organizations to implement continuous planning with automated forecast updates, driver-based projections, and the ability to extend forecasts beyond traditional annual cycles.

Can non-finance users participate in the planning process?

Absolutely. Planful provides role-based interfaces that allow operational department users to input their plans and forecasts with appropriate guardrails. This collaborative approach ensures that financial plans incorporate insights from across the business.

How does Planful handle financial consolidation?

Planful offers robust consolidation capabilities including multi-currency translation, intercompany eliminations, journal entries, adjustments, and support for different accounting standards. The platform can handle complex organizational structures with multiple legal entities and reporting requirements.

Pricing and Subscription FAQs

How is Planful priced?

Planful uses a subscription-based pricing model based on factors including company size, number of users (both power users and casual users), and modules implemented. Pricing is customized for each organization’s specific needs rather than using a one-size-fits-all approach.

Does Planful require annual contracts?

Yes, Planful typically operates on annual subscription contracts, though multi-year agreements are available and often include favorable pricing terms. The enterprise nature of the solution aligns with longer-term commitments.

Are implementation services included in the subscription cost?

Implementation services are typically separate from the software subscription and are scoped based on the complexity of your requirements. Planful offers both direct implementation services and works with implementation partners who provide these services.

Can we add modules or users after initial implementation?

Yes, Planful’s modular approach allows organizations to start with core needs and expand their usage over time. Additional modules and users can be added to subscriptions as requirements evolve.

Support and Help FAQs

What support options does Planful provide?

Planful offers multiple support tiers, including standard support with business hours coverage and premium support with extended hours and faster response times. All customers have access to the knowledge base, community forums, and regular training webinars.

Does Planful offer training for new users?

Yes, Planful provides various training options including implementation training, role-based user training, administrator training, and ongoing education through their Planful Academy. Both virtual and in-person training options are available.

How frequently is Planful updated with new features?

As a cloud-based solution, Planful delivers regular updates to all customers. Major releases typically occur quarterly, with minor updates and enhancements delivered more frequently. These updates are non-disruptive and backward-compatible.

Can we customize Planful to match our specific processes?

Yes, Planful offers extensive configuration options to match your specific planning processes, terminology, and workflows. While the core platform remains consistent, the experience can be tailored to your organization’s unique requirements without custom code.

Conclusion: Is Planful Worth It?

Summary of Planful’s Strengths and Weaknesses

After a comprehensive review of Planful’s capabilities, pricing, and market position, here’s a balanced assessment of the platform’s strengths and weaknesses:

Key Strengths:

- Comprehensive FP&A Coverage: Planful offers a complete solution that addresses the full spectrum of financial planning, consolidation, and analysis needs without requiring multiple point solutions.

- Finance-First Approach: The platform is designed by finance professionals for finance professionals, resulting in capabilities that align well with practical financial processes.

- Balance of Power and Usability: Planful strikes an effective balance between powerful functionality and user-friendly interfaces, making it accessible to finance teams without sacrificing capabilities.

- Strong Financial Consolidation: The platform excels at complex consolidation scenarios, making it particularly valuable for multi-entity organizations.

- Cloud Delivery Model: Regular updates, reduced IT burden, and anywhere access make the cloud approach advantageous for most organizations.

Notable Limitations:

- Implementation Complexity: While less complex than legacy solutions, implementing Planful still requires significant time and resource investment.

- Cost Considerations: The platform represents a substantial investment, particularly for smaller organizations with limited budgets.

- Advanced Analytics: While reporting and analysis capabilities are strong, organizations seeking the most advanced predictive analytics may need supplementary tools.

- Operational Depth: Though improving, some competitors offer deeper operational planning capabilities for specific functional areas.

Final Recommendation and Verdict

Planful represents an excellent choice for mid-market to enterprise organizations looking to modernize their financial planning and analysis processes. The platform is particularly well-suited for:

- Companies outgrowing spreadsheet-based planning and seeking a more robust, connected approach

- Organizations with complex financial consolidation requirements

- Businesses wanting to implement rolling forecasts and more dynamic planning processes

- Finance teams aiming to spend less time on manual processes and more time on analysis

- Companies needing to better connect financial and operational planning

Is Planful worth the investment? For organizations matching the above profiles, the ROI case is compelling. Customers consistently report significant time savings, improved accuracy, and better decision-making capabilities that justify the platform cost. The typical payback period ranges from 12-18 months, with benefits growing as users become more proficient with the platform.

However, smaller organizations with straightforward financial processes may find simpler, less expensive solutions sufficient for their needs. Similarly, the largest global enterprises with extremely complex requirements might consider platforms specifically designed for that scale.

Final Verdict: ⭐⭐⭐⭐½ (4.5/5)

Planful earns a strong recommendation for mid-market and enterprise organizations seeking to transform their financial planning processes. The platform successfully delivers on its promise to modernize finance operations while providing a balanced combination of robust functionality and user accessibility. While implementation requires commitment and the investment is substantial, the resulting benefits to financial operations and decision-making capability provide compelling value for most organizations.